How will the Uk economy recover from Covid 19?

Economies are like human beings. They go through good times when the economy is growing, people have jobs and opportunities but also go through times of real difficulty where living standards are falling and poverty is on the rise. Occasionally they suffer major shocks, rather like the death of a parent or spouse!

In the last 40 or so years or so, the world has suffered 3 major shocks.

1979-1984: The oil price quadrupled in price causing high levels of inflation in Britain and Europe. This was followed by soaring unemployment as businesses tried to cut their costs by laying off workers

2008-2011: The financial Crisis: In 2008 a number of major investment banks such as Goldman Sachs, Royal Bank of Scotland and Lehman Brothers all went bankrupt having recklessly gambled away customer deposits on high risk loans. This led to a major recession through the developed world.

2020 – The Covid 19 virus spread from China to Italy and Europe and throughout the world causing over 2.5 million depths worldwide and leading to lockdowns which have cost jobs and livelihoods.

There are really 2 types of shocks that can affect the world economy. These are demand side and supply side shocks. Demand side affect the level of AGGREGATE DEMAND – normally a sharp fall in Aggregate demand leading to lower Consumption and Investment, while of course Supply side affect AGGREGATE SUPPLY – normally a sharp rise in production costs or a period where the level of production is drastically constrained or cut!!

The 1979 oil price rise was clearly a SUPPLY SIDE shock, the Financial crisis largely a DEMAND SIDE shock. But the Covid 19 crisis has really elements of both.

THE THEORY

Let`s recall our friends Aggregate Demand and Supply.

Agg Demand is the total demand for all goods and services in the economy as a function of price. The formula is Consumption + Investment + Government spending + exports – imports or AD = C+I+G+X-M. A big fall in Consumption and Investment will lead to a fall in AD and a fall in Real GDP and Employment

Aggregate Supply shows the ability of the economy to produce goods at different prices. A lockdown similar to the one we`ve experienced will result in a massive fall in Aggregate Supply.

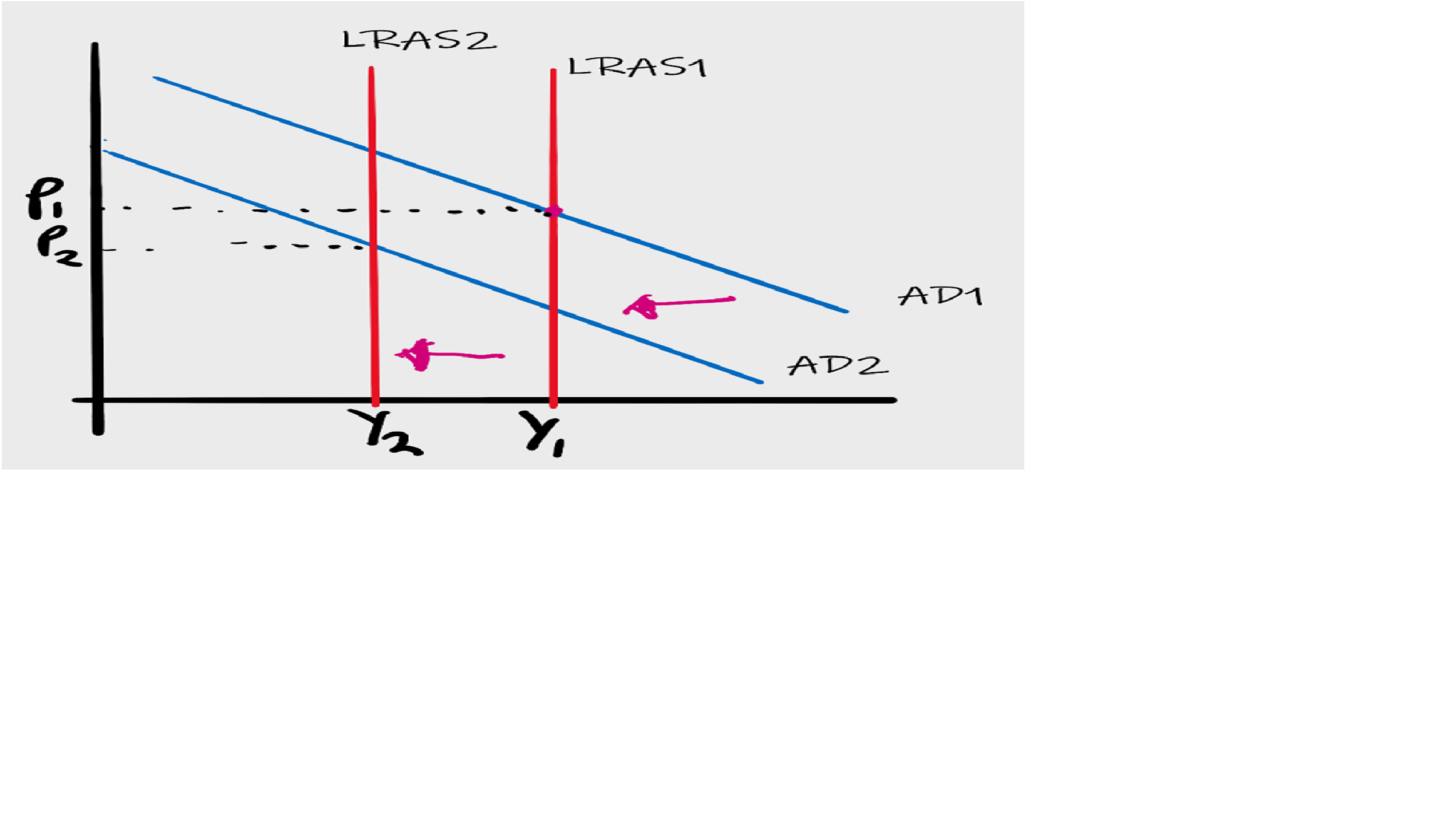

Large fall in both Aggregate Demand and Aggregate Supply

In Britain, both Agg Demand and Supply have been drastically affected. Consumption has fallen due to the lockdown, shops, restaurants, hotels and offices have closed. Some consumer spending has switched to online but there has still been a 14% fall. In normal circumstances this is unprecedented!

With no prospect of higher demand in the future, Investment has also fallen significantly by nearly 20% . Exports (X) have also fallen due to lower demand abroad but also due to Brexit, which has led to some difficulty for exporting business selling in Europe

At the same time the Aggregate Supply has fallen due a number of businesses closing down and most businesses reducing their manufacturing capacity as well as retail outlets being closed. The result has been a big fall in GDP!!!

Despite that, it is expected that the economy will quickly recover once all restrictions are lifted. It is expected that GDP will grow by 7.2% between now and the end of 2021.

More seriously though has been the massive cost to the government of remedial action

What can governments do?

The government response: While C, I and X have fallen, Government Spending has filled the gap. Here is a summary of some of the main government policies to help the Uk economy through this time

The government and the Bank of England really have 3 main types of policies at their disposal.

- Fiscal policy – the use of taxation and government spending

- Monetary policy – the use of interest rates and changes in the money supply available in the banking system

- Supply side policies – a range of measures to improve the economy`s ability to supply goods and services and increase capacity and productivity.

Massive rise in Government spending

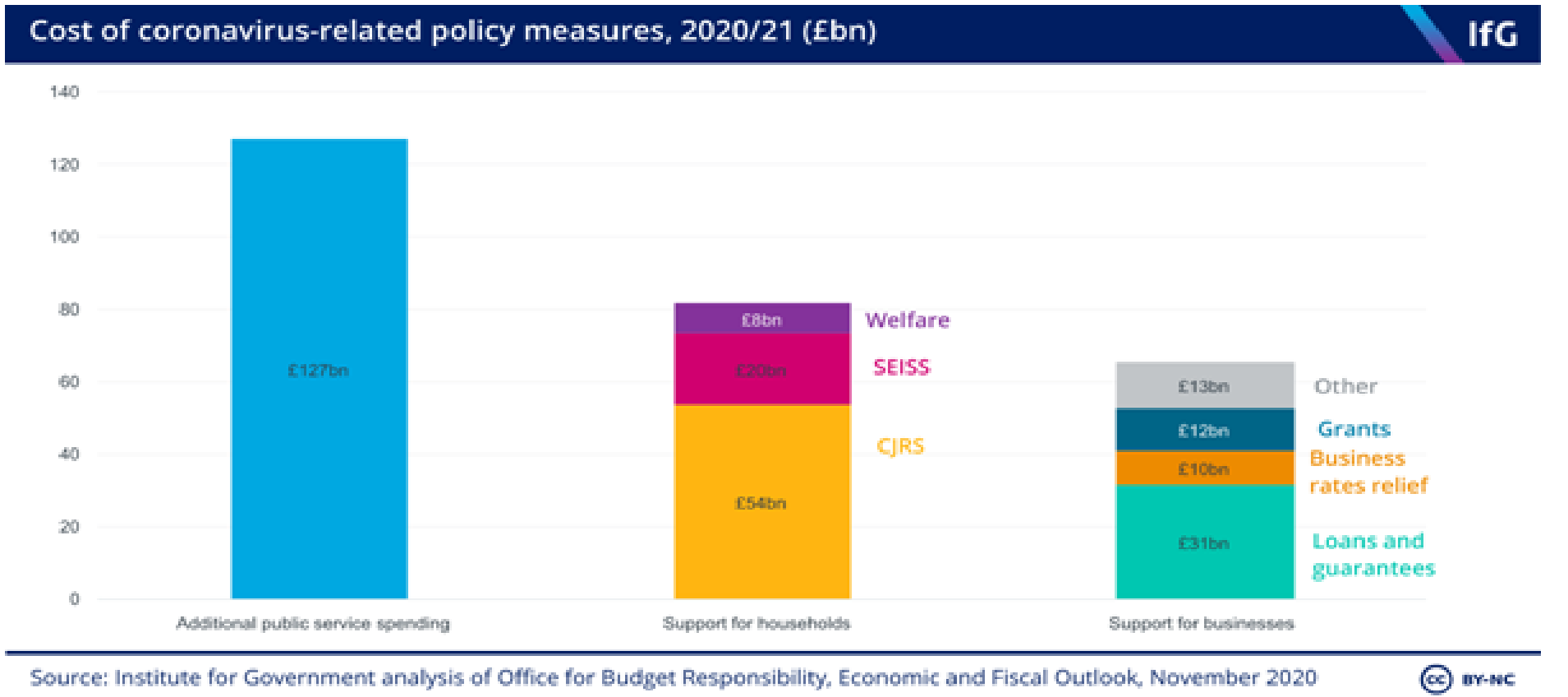

It`s hard to put a figure on this and the figures below are over 6 months out of date. Most likely the government is going to end up spending near double their usual budget. That`s a massive increase!!! And it means a big rise in government borrowing, there are 3 main areas:

- Public services – NHS and the procurement of vaccinations for the whole population and protective equipment etc…. – the biggest (the blue bar below)

- Households – furlough payments for those employees who can`t work due to covid 19 restrictions

- Help for Business – such as shops, restaurants, hotels, cinemas etc who have been closed due to restrictions

The Bank of England

They also have an important role to make sure that they can assist the government in economic recovery and get both inflation nearer the 2% mark and economic growth up.

They do this by:

- Keeping interest rates at a record low of 0.1% – this means it`s very cheap to borrow especially for the government

- Pumping cash into the banking system through their programme of quantative easing which is then used to lend to the government so they can finance their record levels of spending

Improving the supply side

This is an ongoing policy to improve infrastructure and technology in the economy through projects such as the HS2 railway, Northern Powerhouse and 5G Broadband. This will help us to increase supply in the future

Will they succeed?

At the moment, the outlook is quite positive. All that government money in peoples` pockets is like Christmas come early. But many poorer families who didn`t benefit from these schemes are struggling!!

The other problem is there is so much borrowing that sooner or later the government will need to pay the money back. It looks like there will be large tax rises and cuts in government spending in the future. There will be difficult challenges ahead and in many ways the economy may never be the same!!